Here’s a nine-year perspective drawing on data from annual returns filed with the Canada Revenue Agency. It includes years no longer online from the CRA that were included in previous blog posts.

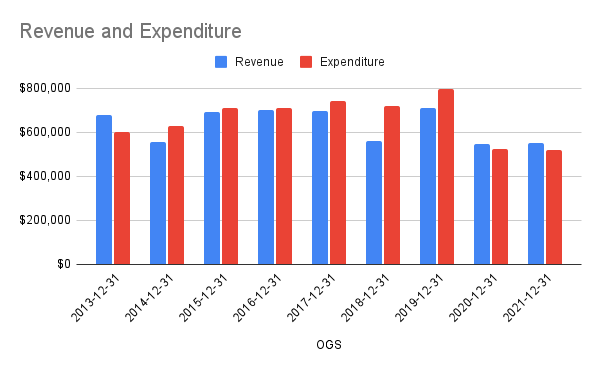

It’s the reduction in both revenues and expenditures in 2020 and 2021 that stand out for the Ontario Genealogical Society. It’s likely not speculating too wildly to link that to the pandemic. With in-person events cancelled there was no need to hire meeting facilities, and no meeting fees to collect. Those two years had surpluses, a turn around from the previous six years, especially 2018 and 2019.

It’s the reduction in both revenues and expenditures in 2020 and 2021 that stand out for the Ontario Genealogical Society. It’s likely not speculating too wildly to link that to the pandemic. With in-person events cancelled there was no need to hire meeting facilities, and no meeting fees to collect. Those two years had surpluses, a turn around from the previous six years, especially 2018 and 2019.

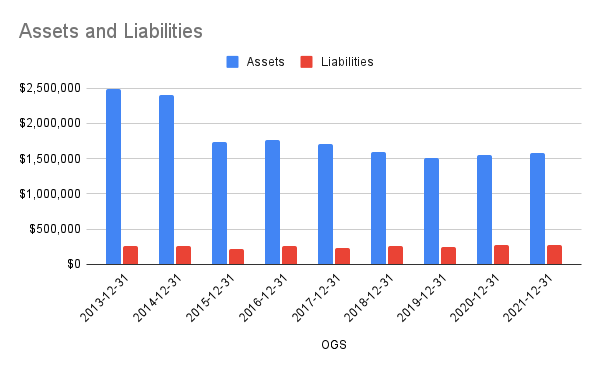

As a result the erosion of the asset base was halted. It had peaked in 2018 when assets decreased by nearly 12% owing to the operating deficit. As a rule of thumb societies like OGS should have a fairly liquid reserve fund of 25 to 30 percent of expenditures. OGS was well within that guideline, as long as it didn’t continue. It didn’t.

As a result the erosion of the asset base was halted. It had peaked in 2018 when assets decreased by nearly 12% owing to the operating deficit. As a rule of thumb societies like OGS should have a fairly liquid reserve fund of 25 to 30 percent of expenditures. OGS was well within that guideline, as long as it didn’t continue. It didn’t.

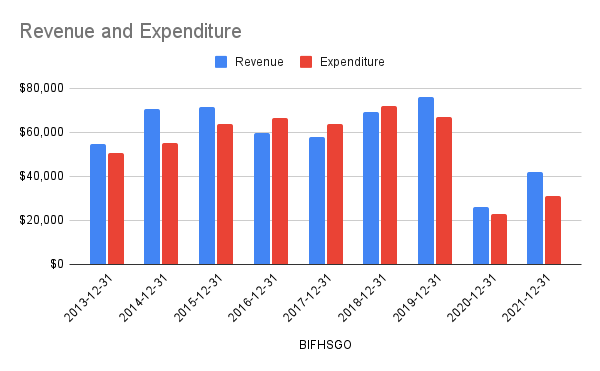

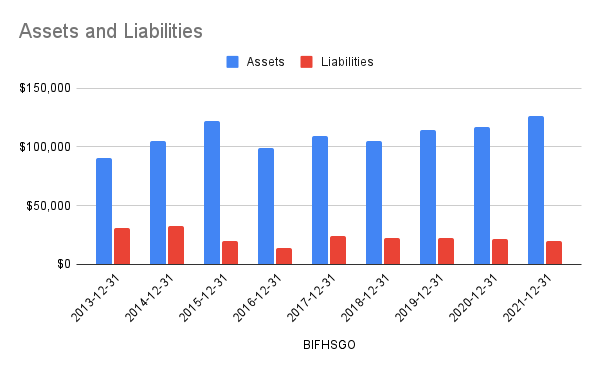

The British Isles Family History Society of Greater Ottawa, a much smaller organization, showed a similar pandemic reduction in revenues and expenditures in 2020 and 2021. BIFHSGO doesn’t have the fixed expenses of an office and paid staff of OGS so the reduction is more marked. BIFHSGO had operating deficits from 2016 to 2018, nearly 8 percent of net assets in 2018.

In 2021 BIFHSGO’s net assets were the greatest ever for the nine year period, and probably since the organization was founded.

The organizations don’t exist to have the biggest surplus, or the healthiest amount of assets. An excessive surplus and unnecessarily large asset base may be interpreted to mean the organization is not doing all it could to meet its objectives.